(continued from part 1 and part 2)

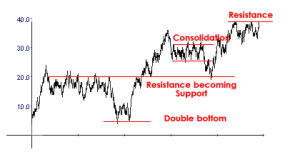

My original method, the one used in my journal thread, was based on Fibonacci retracements. Keep reading before you flame me: I don’t think Fibonaccis are special, and I joke about people who think they have magic powers.I do not believe that a 38.2% retracement is really any fundamentally different than 38.1% or 38.3%, or 43.6%, or 19% or 39.4%, or any other number. Literally any number will work just as well because, say it with me, price is random. Do you think price goes “hey, this is a 38.2% retracement! Time to go the other way now!” No. And do you think the market makers do that?

I do not believe Fibonacci numbers are special. I know that some people are pretty serious about using Fibonacci number tick or volume charts as if the Fibonacci number is somehow magic and will work better than any other number. That’s all nonsense.

When I first shared my method elsewhere a few years ago, the discussion quickly turned into an argument between people who think that because Fibonacci numbers may sometimes be found in nature, they are therefore applicable to trading, and the people who think that’s a bunch of crazy talk.

I decided to share this method because of a few conversations I had been having with people who were paying a monthly fee to some “guru” to learn how to trade with Fibonaccis. None of them were making any money (other than the “guru” who was collecting monthly subscriptions), and the thing I noticed is that these “gurus” were always extremely vague.

They would post after the fact charts where price happened to bounce off of a Fibonacci level and say “see?! Fibonacci retracements work!”

The gullible students would say “wow u r so smart! Here pleez take my money to teach me!”

But the people who had more accurate BS detectors see that that is all nonsense. Without knowing ahead of time if price was going to bounce off a Fibonacci level, and if so, which one, such a method is useless.

I originally used two methods: one for daytrading the ES, and one for long term trading SPY (or SSO). The daytrading system is much crazier and I will talk about it later. Since I don’t daytrade regularly anymore, let’s just talk about the longer term system.

This is a long term system so we’re using daily charts.

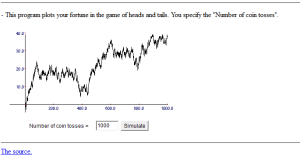

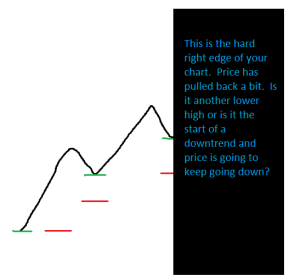

The general idea is that since price is random, we know that it goes down and up, but we don’t know when it’s going to either, nor for how long. We do know that it can’t go to negative, and we have a pretty good chance that the S&P will not go to 0.

Do not use margin. You are going to be averaging down quite often. Using margin is a good way to blow your account when SPY goes one penny further than you can afford. If you do not use margin you cannot blow your account.

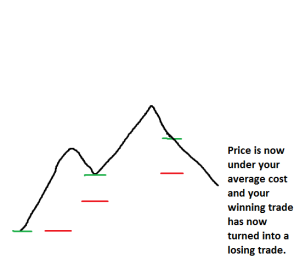

The initial profit target will be the previous high. Depending on how far your position goes against you, you may wish to change the target in the future (for example, if you start buying SPY at 140, and it eventually drops to 90, you might not still want to have to wait for it to get back up to 140 before you close your position).

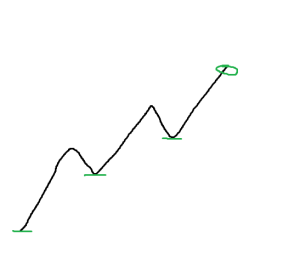

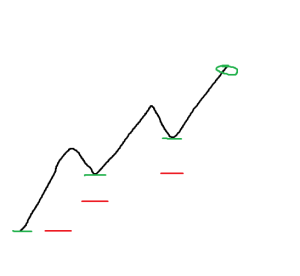

Step 1: Wait for SPY to make a pullback. You can use Fibonacci retracements if you want. I did for the sake of proving the point that Fibonaccis can be traded profitably but it really doesn’t matter. You can use 25% increments, you can use 30%, or 42%, or 51% or anything you want. There are no magic numbers. When price has pulled back to your level, buy a small amount.

Step 2: Buy more SPY when it goes against you another predetermined amount (perhaps the second Fib retracement, perhaps a random percentage, etc).

Step 3-x: Continue to buy more SPY when it continues to go against you. Again, you can use Fibonaccis, or you can divide its current price into increments (such as if SPY is at $140 and you buy every time it drops $10), or into percentages (such as if you buy every time it drops a certain percentage), etc. Remember that each add is going to be bigger than the previous. This is averaging down. Remember that you are not using margin. Begin your first add with a small enough size that you can continue to buy more as it goes against you. If SPY is $145 and you keep buying all the way down to $100 and then run out of money and then SPY goes down to $80, you did it wrong.

Remember, price is random so you have no idea how far it’s going to go down.

Some of the trades will be awfully slow and boring. I currently have a trade in QLD that has been open since November of 2012 and has barely gone anywhere. I didn’t know QLD was going to chop for a few months when I bought it. Patience, remember. Not every trade will end up in a huge winner. Some of them will just be small winners.

Ok I’ve been spending a few hours writing this now and need to take a break. There is much more to discuss, including:

– hedging a SPY position with SH to make money when your SPY position is drawing down

– uptrends and random entries

– using covered calls in slow boring uptrending markets

And some more rules to be discussed, such as why I never add to a winning position.

And now to preempt some of the inevitable questions and criticisms:

1) “Dude you are so dumb, this isn’t trading.”

Well, I’m making money buy buying and selling stocks, so yeah, it is trading. And I’ve been consistently doing so for years with every trading posted in real time, so… yeah.

2) “This system sucks and doesn’t make money in big up trends. That’s when all the big money is made. I know because some “guru” told me so. You would know that if you were a real trader. Trend following for lyfe!!1!1!!!!”

Yeah, I don’t make much in big up trends unless I happen to have a big position from a previous downtrend. That doesn’t always happen. But I also don’t have big losses following downtrends the way most people do. And when price goes up and down I do pretty well.

3) “You idiot, you are basically just throwing a lot of money at the market and when it eventually rebounds, you make money.”

Yup. Since I cannot predict price, this is how I have to do it. I view the markets as a mathmatical random sequence rather than whatever you view them as. If you were going to make money from a random sequence, how would you do it? Averaging down, that’s how.

Look, this is not everyone’s holy grail. Sometimes it works very well. Sometimes it doesn’t produce big winners.

If you can predict price, keep doing what you are doing. If I could predict price I would just enter in the correct direction with my entire account on each trade. There would be no reason to start small and add more as price goes against me.

I fully admit that this method is inferior to price prediction methods. But I’ve never seen anyone who could successfully predict price, and until I am able to do so myself, I will continue to trade this way.

To give you an example of a complete trade that lasted a whlie, on October 27, 2011, I closed out a trade that had been open for a while. This was the previously mentioned trade that at one point was drawn down over $60,000. On October 31, 2011, the dividend was paid and the final numbers looked like this:

SPY: $31,115.00 (closed)

hedge: -$3,281 (closed)

$27,834.00 (SPY gain + open hedge loss)

$1,223.60 (realized hedge gain)

$2,931.69 (realized hedge gain)

$1,129.72 (dividend)

$3,562.22 (dividend)

$5,221.55 (realized hedge gain)

————————

$41,902.78 (total for trade)

I had a SPY position which I had been continually adding to, several SH positions that had been closed and reopened, two dividend payments, and a currently open SH position that was closed at a loss.

That’s how I trade as if price is random.